Zcash price has gone vertical since October, rising from below $50 to over $475, making it one of the best-performing tokens in the crypto industry.

- Zcash price has jumped to a record high this month.

- The Wyckoff theory points to an eventual crash in the near term.

- ZEC price has moved into an overbought territory.

Zcash (ZEC) token jumped to a high of $475, up by 1,265% from its lowest level this year. Its market cap has jumped to over $7.5 billion, making it bigger than Monero (XMR), which is valued at $6.7 billion.

ZEC price rally was triggered by Grayscale, which launched a Zcash Trust, which has gained over $162 million in assets. Still, there are at least four main fundamental and technical reasons why the token price will crash soon.

Wyckoff Theory points to a Zcash price crash

One technical reason for the ongoing Zcash price surge is the Wyckoff Theory, developed over 100 years ago. This theory states that an asset typically goes through four stages: accumulation, markup, distribution, and markdown.

The accumulation phase is characterized by horizontal movements and low volume, while an asset surges during the markup phase.

In this case, the Zcash price has remained in a tight range since June 2022. It remained between the support and resistance levels at $16 and $80 in this period.

The ongoing surge is a sign that it has moved to the markup stage, which is characterized by high demand and Fear of Missing Out.

Therefore, the coin will likely move into the distribution and markdown phases, where an asset begins to fall amid panic selling by retail investors.

ZEC price is now overbought as a rising wedge forms

Zcash price could also be at risk of a crash because of other technical factors. For example, top oscillators show that it has become a highly overbought coin.

The Relative Strength Index has moved to the extremely overbought level of 80, while the two lines of the Stochastic Oscillator have moved above 90.

These overbought conditions have coincided with the formation of a rising wedge pattern, which is made up of two ascending and converging trendlines. A bearish breakout normally happens when these two lines are about to converge.

Zcash and mean reversion risk

The concept of mean reversion suggests that asset prices tend to move towards their historical averages. In this case, the coin has deviated substantially from its historical averages as the standard deviation has jumped to 80.

While Zcash price trades at $462, the 50-day and 100-day Exponential Moving Averages are at $242 and $168. Therefore, there is a likelihood that the coin will retreat so that it can move closer to these averages.

Soaring open interest and negative funding rate

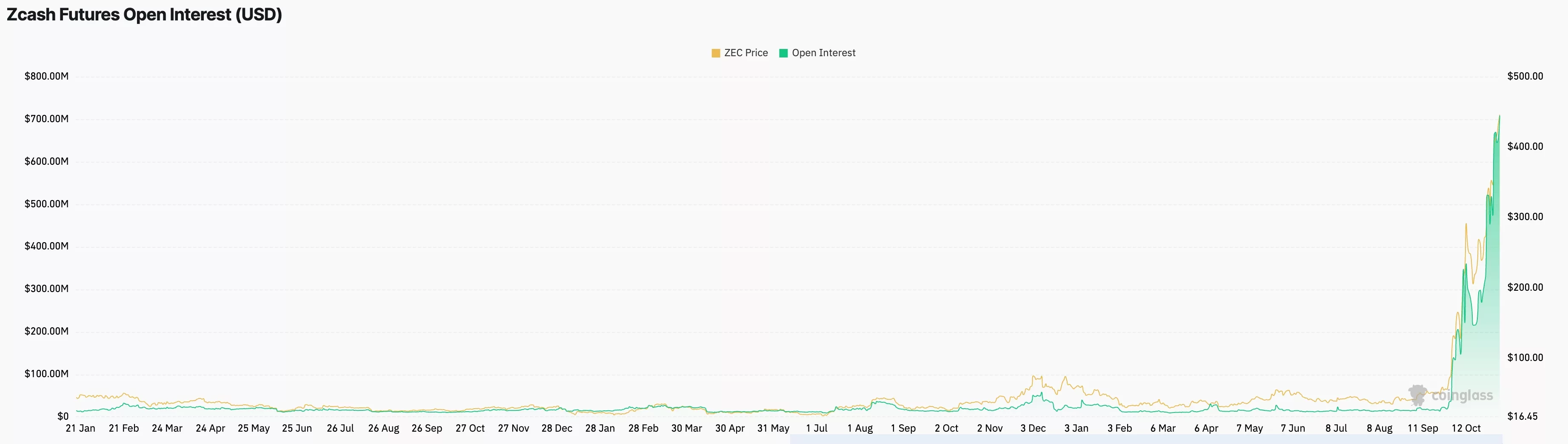

The futures market suggests that a Zcash price retreat could be near. CoinGlass data shows open interest has jumped to a record high of $708 million, up from the September low of $10 million.

Rising futures open interest is a sign of strong demand for the coin, which is a positive. However, in most cases, cryptocurrencies start to plunge when interest reaches an extreme level.

The funding rate usually confirms these declines. A high open interest and a negative funding rate often result in a bearish breakout. CoinGlass data shows that the funding rate has remained in the red since October 22.