MSTR stock price crashed on Monday and formed a highly bearish pattern pointing to a 30% dive in the coming weeks.

- MSTR stock has formed a death cross pattern on the daily chart.

- This pattern points to a 30% dip in the near term.

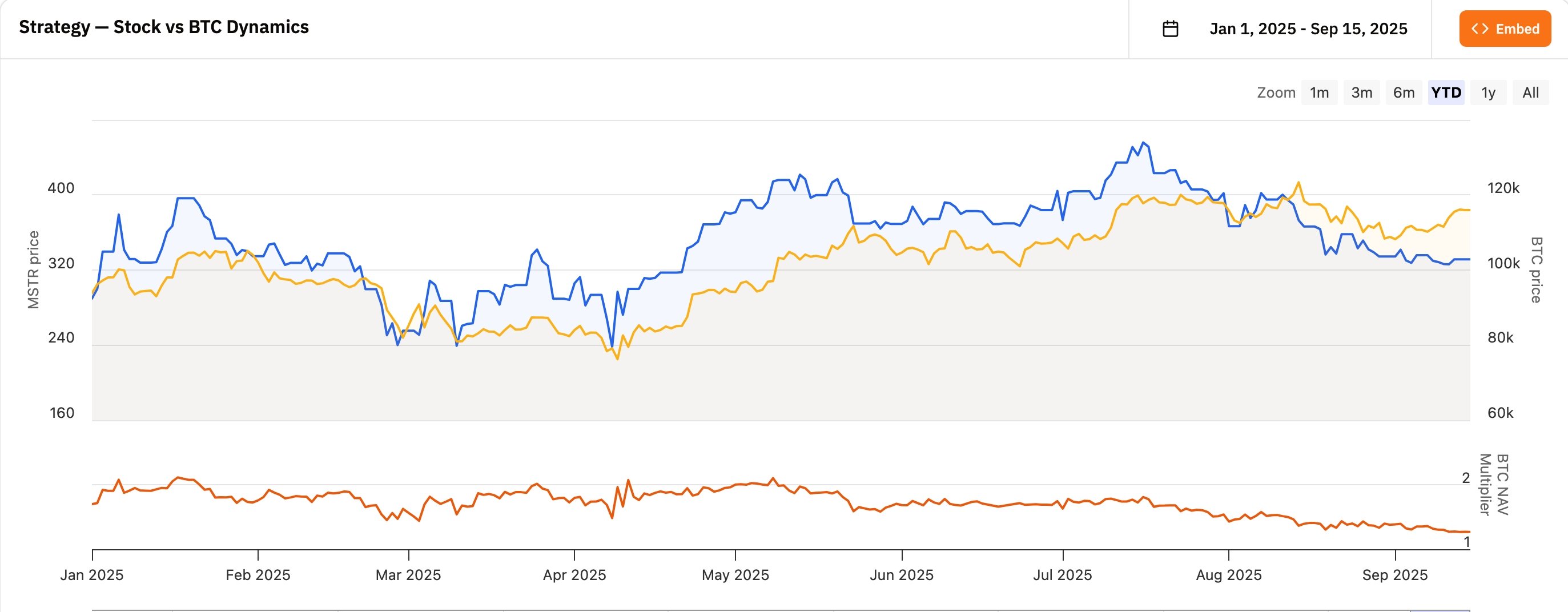

- Strategy’s NAV has continued its strong downtrend.

Michael Saylor’s Strategy dropped to a low of $323, its lowest level since April, and is 40% below its highest point in 2023. It has underperformed Bitcoin (BTC), which is about 7.2% below the year-to-date high.

MSTR stock price technicals point to further downside

The daily time frame shows that the Strategy share price has been in a strong downtrend in the past few months. It has dropped below the important support at $360, the May low.

Most importantly, it has formed a death cross pattern as the 50-day and 200-day weighted moving averages have crossed. This crossover often leads to further downside.

Oscillators also show that the stock may continue falling. The Relative Strength Index continues its downtrend and is hovering near the oversold level around 30. The Percentage Price Oscillator also continues to fall.

Therefore, the most likely MSTR stock price forecast is bearish, with the next target at $230, the March low, which is about 30% below the current level.

Falling mNAV and increasing dilution

A major concern among investors is that Strategy’s modified net asset value, also known as mNAV, has been on a downward trend and now stands at 1.25, down from last year’s high of 3.4.

The mNAV figure is an important figure for Strategy because it looks at how much extra value investors assign to its Bitcoin holdings. For a long time, the company’s policy was not to sell shares when the mNAV figure was below 2.5 until Saylor changed the rule in August.

As such, concerns persist that shareholder dilution will continue, given the company’s primary reliance on at-the-market offerings to raise capital rather than issuing preferred shares.

The MSTR stock price has crashed as demand for treasury companies has waned. A closer look shows that most Bitcoin treasury companies, such as Metaplanet, Trump Media, Bullish, KindlyMD, and Semler Scientific, have seen their stocks plunge.