Latin America’s crypto media ecosystem collapsed in the second quarter of 2025. The region previously boasted heavy competition in the form of six top-tier crypto outlets, but it has now shrunk to just one: CriptoNoticias.

Our latest analysis shows that while adoption in the region is booming, up 18.3% quarter-over-quarter, crypto-native media visibility fell 54%, leaving mainstream publishers to capture most of the audience.

We’ve covered earlier Outset PR snapshots on crypto.news, including Western Europe’s MiCA reset, Eastern Europe’s mixed rebound, and LATAM’s Q1 decline. This Q2 piece continues that series.

Booming adoption but collapsing media

Latin America was a crypto hotspot throughout Q2. Visa’s stablecoin-linked cards launched across six countries, Bybit introduced a LATAM-only P2P push, and Argentina advanced a tokenization effort while exploring tax payments in crypto.

Yet despite clear momentum, crypto-native news outlets lost more than half of their audience in the second quarter. This was not a one-off, as declining trends began in early 2025.

In Q1, six LATAM publications each attracted 400,000 monthly visits. By the end of Q2, only CriptoNoticias maintained this level of readership with an average of 448,000 visits per month, or 1.35 million total visits.

Former industry giants, such as Cointelegraph Brasil, slipped into the mid-tier category, with peers such as Bitfinanzas, Livecoins, DiarioBitcoin, CriptoFácil, and Portal do Bitcoin confined to the 130,000–400,000 range.

Data sourced from Similar Web and visualized by Outset PR

These mid-tier outlets still accounted for the majority of crypto-native traffic with a combined 58% market share. Even with a loyal readership base, the 30 smaller sites we tracked accounted for just 26% of visits.

Mainstream outlets and industry momentum

Total visits at generalist portals rose 8% from the first quarter to 263.2 million in the second quarter and far outpaced the 8.2 million visits that crypto-native outlets combined. In Argentina, mainstream news sites such as Infobae and Ámbito dominated with 56% of all broader media traffic.

Our findings show that 72% of crypto-native outlets lost visibility, while mainstream outlets capitalized on favorable trends to expand their reach and serve crypto enthusiasts. The reality is that larger sites boast key advantages, including scale, diversified content, and stronger SEO authority.

AI disruption reshapes discovery

We reached out to LATAM news editors to validate our findings. The survey and the data tell the same story: Google referrals shrank in the quarter as readers used ChatGPT and Perplexity for quick answers to their questions.

One editor told Outset PR: “The drop in search traffic hit us hard; we’re now optimizing for AI intent instead of keywords.”

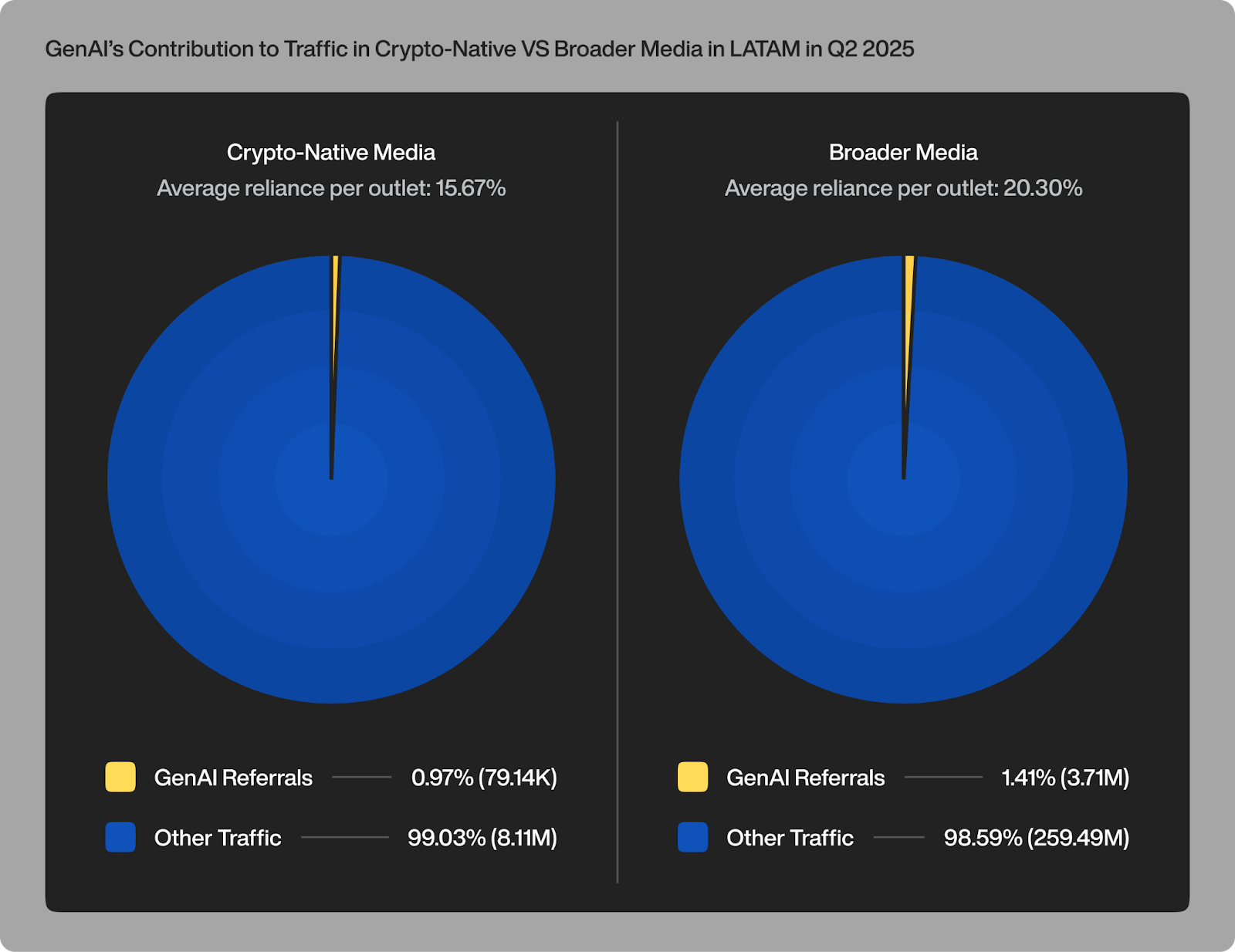

In Q2, AI referrals accounted for 0.97% of crypto-native traffic and 1.41% for mainstream sites.

The gap likely comes down to size, as bigger platforms show up more in AI answers. For some crypto news outlets, AI accounted for more than 40% of referrals, while other sites drew zero readers. This uneven impact should concern publishers, and the time to act is now, as crypto-native media is at risk of being overlooked in the AI-driven discovery era.

Final thoughts: part of a wider global trend

The LATAM industry problems are nearly identical to what we found happening in Europe. Specifically, Western Europe’s Q1 reset under new MiCA regulations resulted in 82% of crypto sites losing traffic. Similarly, Eastern Europe’s Q2 analysis found that 63% of sites saw declining traffic during the peak of the bull market.

According to Chainalysis, Latin America ranked as the second-fastest-growing region for on-chain crypto activity during the second quarter, so some might find declining crypto readership a bit puzzling. But this is the reality, and with just one top-tier player left, the balance of power has shifted toward local generalist outlets that happen to cover crypto.

For crypto publishers, survival means adapting to AI discovery, diversifying traffic sources, and building loyal direct audiences. For the broader industry, it means recognizing that PR and education strategies must increasingly target mainstream platforms, even in regions where crypto enthusiasm runs highest.

Our prior reports concluded that industry momentum also does not attract an audience, as the challenge is structural. Outlets that are able to adapt early could shape how crypto in Latin America is delivered to readers.