MLG crypto saw a dramatic price spike but quickly gave up most of its gains after allegations of an influencer-led pump-and-dump scheme surfaced. Should you invest in MLG?

- MLG crypto jumped over 180% on July 29 before falling back to $0.013.

- Much of the hype was driven by controversy around an alleged pump-and-dump scheme involving MLG.

- The Solana-based meme token trades primarily on decentralized exchanges like Raydium and LBank.

According to data from crypto.news, the token surged more than 180% to reach an intraday high of $0.023 on Tuesday, July 29. However, the rally was short-lived. The price soon pulled back and stabilized around $0.0122 at the time of writing.

Despite the recent spike, MLG remains nearly 92% below its all-time high of $0.162, recorded earlier in January 2025.

What is MLG?

MLG is the ticker symbol for 360noscope420blazeit, a Solana-based meme token launched in April 2024. The name “MLG” is a nod to Major League Gaming and draws inspiration from the early 2010s Call of Duty and competitive gaming culture, often referred to by fans as the “golden era” that the MLG crypto pays homage to.

However, it’s important to note that MLG crypto has no official connection to Major League Gaming or its parent company, Activision. While the token uses similar visuals and themes, these are part of its nostalgic meme appeal, not an authorized brand partnership.

Why did MLG rally?

The latest rally appears to have been driven by a surge in social media hype and trading activity, particularly after it was allegedly promoted by high-profile influencers, including FaZe Banks, co-founder of the esports organization FaZe Clan.

Trading volumes spiked across platforms like Raydium and LBank, with the MLG/SOL pair becoming one of the most active on Solana-based decentralized exchanges.

The controversy intensified after Banks and streamer Adin Ross were accused of manipulating the token’s price for profit. Both denied any wrongdoing, though Banks announced he was stepping down as CEO of FaZe Clan, citing emotional burnout and damage to his reputation.

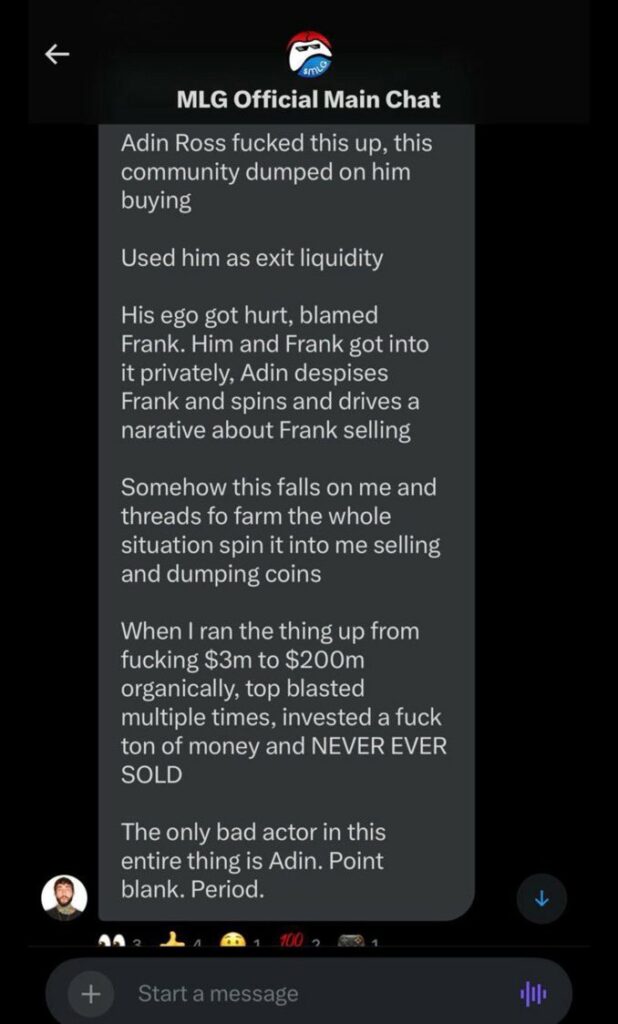

In a screenshot that has been making rounds on X, Banks was seen accusing Ross:

The backlash contributed to the token’s sharp retracement shortly after peaking.

This isn’t FaZe’s first brush with crypto controversy. In 2021, several FaZe Clan members were involved in promoting the “Save the Kids” token, which quickly collapsed after launch.

FaZe Kay was removed from the organization, while others were suspended, following allegations of insider trading and deceptive marketing. That history has added further skepticism around MLG’s recent pump.

Should you invest in MLG?

At present, MLG remains a highly speculative asset. Its value is not backed by any formal utility, revenue, or product roadmap, but instead depends on community momentum, nostalgia, and influencer-driven hype. While it may offer opportunities for short-term gains, its long-term investment prospects are highly uncertain.

A major concern for prospective investors is the nature of its trading environment. MLG is primarily traded on decentralized and lightly regulated exchanges such as Raydium, LBank, XT.COM, and Meteora.

These platforms tend to have tighter liquidity controls and fewer restrictions, which makes it easier for whales or coordinated groups to manipulate price action without oversight. This increases the token’s volatility and makes it vulnerable to pump-and-dump cycles, particularly during hype-driven rallies.

For traders with a high risk tolerance, MLG may offer exposure to fast-moving price swings and the cultural novelty of meme coin trading. But for cautious or long-term investors, the lack of transparency, high volatility, and history of influencer-linked manipulation should be viewed as serious red flags.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.