How did Ethereum follow its worst quarter since 2022 with a 175% rebound, and can ETFs and tokenization sustain that momentum?

Table of Contents

Ethereum’s 175% rebound since april

Ethereum (ETH) has been quietly mounting one of its strongest recoveries in recent years. After falling to a low of around $1,386 in early April 2025, the second-largest crypto by market value began to steadily climb, nearly doubling by early June.

The recovery has continued. On Jul. 20, ETH breached the $3,800 mark and, as of Jul. 21, is trading close to $3,800, reclaiming lost ground and returning to levels last seen in late 2024.

In the first quarter of 2025, ETH declined by nearly 12%, marking its weakest quarterly performance since 2022. However, the second quarter brought a reversal, with the asset gaining roughly 30%, more than offsetting earlier losses.

From the April low, Ethereum’s total price increase now stands at approximately 175%, placing the second quarter among its most successful periods on record.

Ethereum’s upward move has taken place alongside a broader market recovery, particularly the renewed strength in Bitcoin (BTC). Still, Ethereum’s rebound has outpaced Bitcoin’s in relative terms.

Let’s understand what’s driving this rebound, what changes are coming to the Ethereum network, and how it stacks up against competing platforms.

ETF inflows and reduced supply support the rally

Ethereum’s rally since April has been supported by a combination of structural and demand-driven catalysts.

One of the clearest indicators is the renewed capital flow into Ethereum-focused exchange-traded funds.

ETF behavior in June marked a sharp departure from the caution observed during the first quarter.

Spot ETH ETFs attracted $1.13 billion that month, surpassing the inflows seen in April and May. BlackRock alone was reported to have added over $500 million worth of ETH in just two weeks.

Network dynamics have also played a role in reinforcing Ethereum’s price recovery. In mid-2025, the number of ETH staked surpassed 35 million, effectively removing about 28% of the circulating supply from trading activity.

Validator contracts now hold nearly $96 billion in ETH, which has contributed to supply tightening.

Moreover, as stablecoins regain prominence in 2025, Ethereum’s position as their primary foundation became more visible.

Circle’s public listing highlighted this relationship. The firm’s share price surged 270% in its first week, redirecting attention to the USD Coin (USDC) ecosystem, which is largely built on Ethereum.

Meanwhile, reports from firms like Bernstein have positioned Ethereum as the underlying architecture for tokenized money, lending markets, and asset settlement, suggesting it could capture growing value as adoption deepens.

Real-world asset tokenization is becoming a key part of this narrative. As of mid-2025, Ethereum accounts for over 55% of tokenized assets across public blockchains.

Despite recent gains, Ethereum’s market cap remains far below Bitcoin’s. On Jul. 21, ETH’s valuation stood near $400 billion, compared to Bitcoin’s $2.3 trillion.

Ethereum builds toward higher throughput

Ethereum developers have continued advancing key protocol upgrades, and 2025 has already delivered a major milestone in that process.

In May, core contributors implemented the “Pectra” hard fork, a broad update that merged two separate upgrade tracks, Prague and Electra, into a unified release covering both the execution and consensus layers.

Pectra introduced over a dozen technical improvements. Among them was EIP-7702, aimed at advancing native account abstraction.

In practical terms, this narrows the gap between user wallets and smart contracts, offering the potential for more flexible and programmable wallet designs.

One of the notable additions was a new cryptographic framework, BLS12-381 precompiles, which enhances support for privacy-preserving applications such as zk-SNARKs.

The upgrade also improved the staking experience through features like triggerable exits, which provide validators with more control over withdrawal timing.

Smart contract developers now have access to the Ethereum Object Format (EOF), a newly designed system that helps streamline contract code and improve safety.

Further refinements to Ethereum’s data “blob” mechanism also continued the network’s progress toward more scalable data availability, building on earlier sharding-related efforts.

Two additional upgrades, Fusaka and Glamsterdam, are already in development.

Fusaka, expected later in 2025, will introduce PeerDAS, a data sampling technique that enables nodes to verify large volumes of blockchain data more efficiently.

This forms part of the groundwork for Ethereum’s longer-term objective of implementing danksharding, a structure intended to support higher transaction throughput with reduced operational complexity.

Glamsterdam, planned as a follow-up, will focus on optimizing gas costs and improving broader network performance, especially during periods of heavy activity.

All of these upgrades fit into Ethereum’s long-term roadmap, which organizes its evolution into thematic phases including The Surge, The Scourge, and The Verge.

The overall goal is to make Ethereum capable of processing over 100,000 transactions per second through a rollup-centric model, while preserving decentralization and security.

Corporate strategies reflect deeper conviction in ETH

Ether is beginning to take on a larger role in institutional portfolios, as public disclosures in recent months have shown a steady rise in corporate ETH accumulation. In mid-2025 alone, public companies acquired over $1.6 billion worth of ETH.

SharpLink Gaming was among the first movers, restructuring itself into an Ethereum-focused holding company under the leadership of Joe Lubin, one of Ethereum’s original co-founders.

Within a few weeks, the firm had acquired approximately 280,000 ETH, valued at more than $840 million. Lubin characterized the wave of institutional demand as persistent, comparing it to an industrial vacuum absorbing ETH from the market.

Bit Digital, a Nasdaq-listed company, took a similar approach. The firm shifted its focus entirely to Ethereum in June 2025, building a treasury of over $436 million as of this writing.

Its CEO described Ethereum not just as a financial asset but as programmable infrastructure supporting a broadening set of real-world use cases, including staking and decentralized finance.

Several other firms have announced related strategies. On Jul. 17, BitMine Immersion reported that its Ethereum holdings had exceeded $1 billion, more than tripling the $250 million it had raised through a private placement just a week earlier.

BTCS Inc., an early blockchain-focused company, increased its Ether reserves to nearly 29,000 ETH. GameSquare, a company in the gaming sector, committed $100 million toward Ethereum accumulation as part of its broader blockchain roadmap.

The growing interest from corporate treasuries may also be a bet on price appreciation. Ethereum’s staking mechanism allows holders to earn annual yields of around 4–5%, offering a return on idle capital that conventional fiat reserves are not designed to match.

Ethereum leads in value, Solana and BNB in activity

Ethereum continues to lead in ecosystem depth and capital concentration, while other smart contract platforms have grown quickly, each offering distinct advantages in speed, cost, or user engagement.

Solana (SOL) and BNB Chain (BNB) stand out among the challengers. Both have attracted large user bases and sustained high daily activity by focusing on fast throughput and low transaction fees.

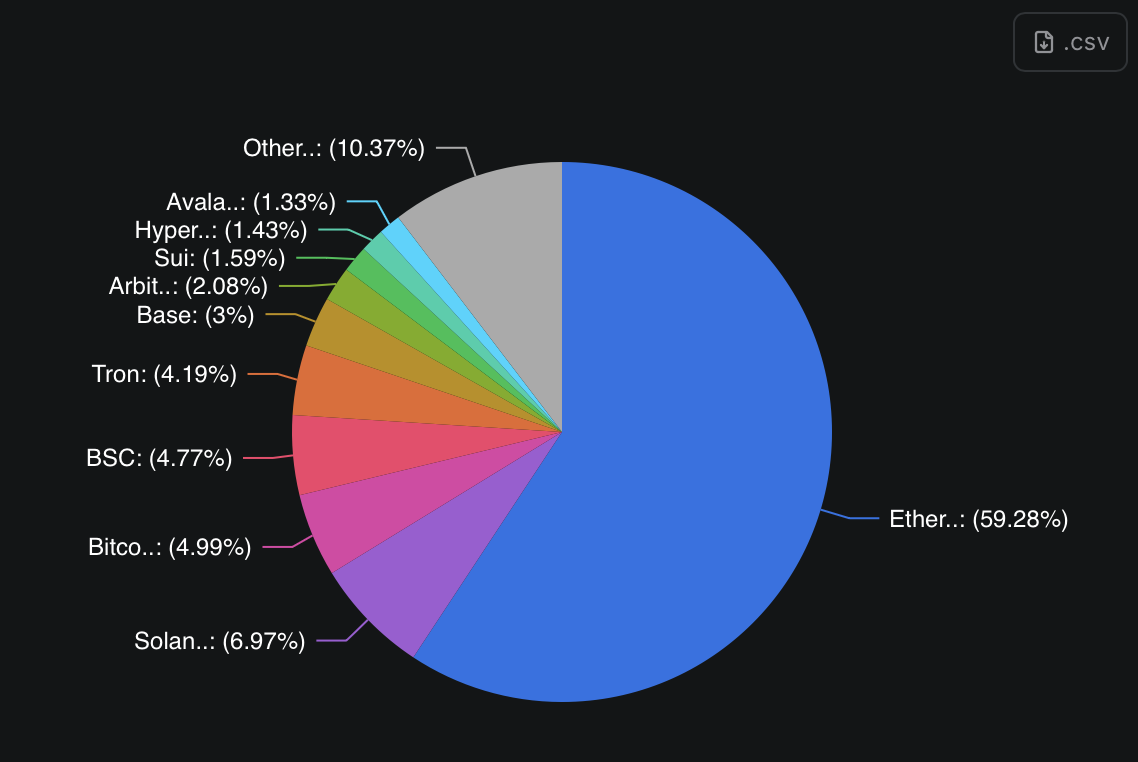

In terms of value secured on-chain, Ethereum remains the dominant network. It holds close to 60% of the total value locked across major DeFi protocols, amounting to around $84.5 billion at the time of writing.

Support for this scale comes from Ethereum’s broad ecosystem, with nearly 1,400 decentralized applications live on the network. In comparison, Solana supports around 230 applications.

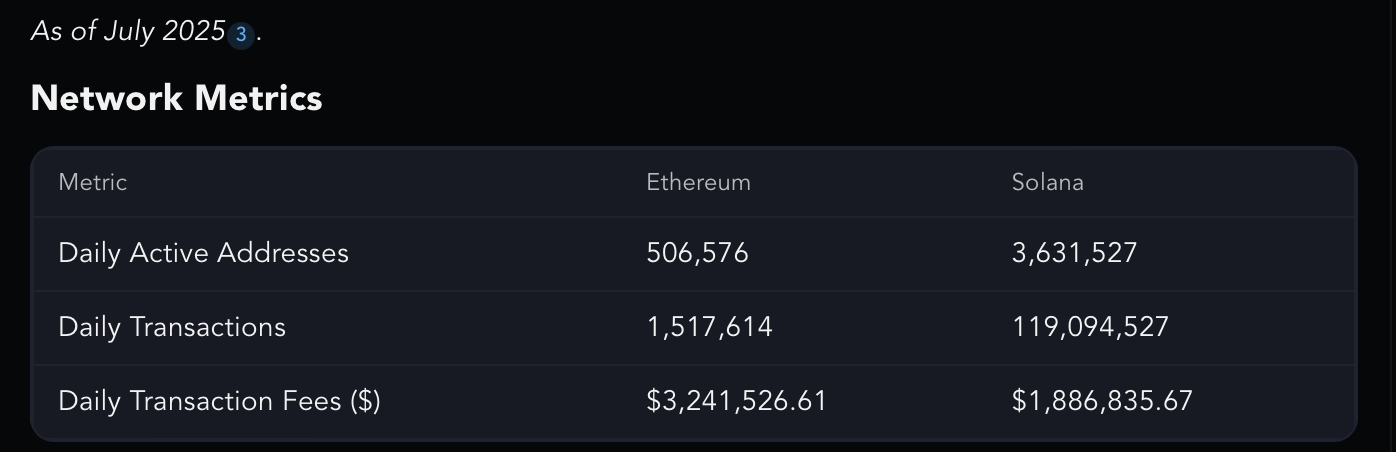

Activity-based metrics, however, tell a different story. Solana consistently processes over 100 million transactions per day, far exceeding Ethereum’s daily average of 1 to 1.5 million.

Solana also leads in daily active wallets, occasionally surpassing 3 million, while Ethereum tends to range between 400,000 and 500,000.

BNB Chain has shown similar momentum. After recent infrastructure upgrades, the network records close to 2 million daily users and produces approximately 115,000 blocks each day.

On certain days, BNB Chain has even outperformed Ethereum in decentralized exchange volume, including one instance in June where it registered $21.2 billion in trades, compared to Ethereum’s typical range of $1 to $2 billion.

These figures highlight high-frequency usage, but they do not fully reflect economic density. Ethereum still generates higher daily fee revenue, reaching $3.24 million as of July, which suggests that users conducting larger-value transactions continue to favor the network.

Network decentralization also remains a key differentiator. Ethereum is supported by more than 500,000 validators, contributing to its resilience and trust assumptions.

Solana, with a smaller validator set and more demanding hardware requirements, has drawn scrutiny over potential centralization risks.

The result is a fragmented but complementary market. Solana and BNB Chain lead in transaction volume and retail-level participation, often driven by applications involving meme tokens, gaming, NFTs, or micro-scale DeFi.

Ethereum, on the other hand, remains the primary venue for high-value financial activity and deeper liquidity. It anchors most of DeFi’s total value and generates higher protocol-level revenue despite lower raw activity.

Going forward, Ethereum’s challenge lies in improving accessibility while retaining the qualities that have positioned it at the core of Web3 financial infrastructure.How did Ethereum follow its worst quarter since 2022 with a 175% rebound, and can ETFs and tokenization sustain that momentum?

ETH’s 175% rally since April marks one of its sharpest reversals in recent years, a rally that suggests deeper conviction is finally taking shape in this cycle.