The latest report by Chainalysis shows that North America continues to play a central role in the crypto ecosystem.

- U.S. and Canada accounted for 26% of all global crypto activity between July 2024 and June 2025

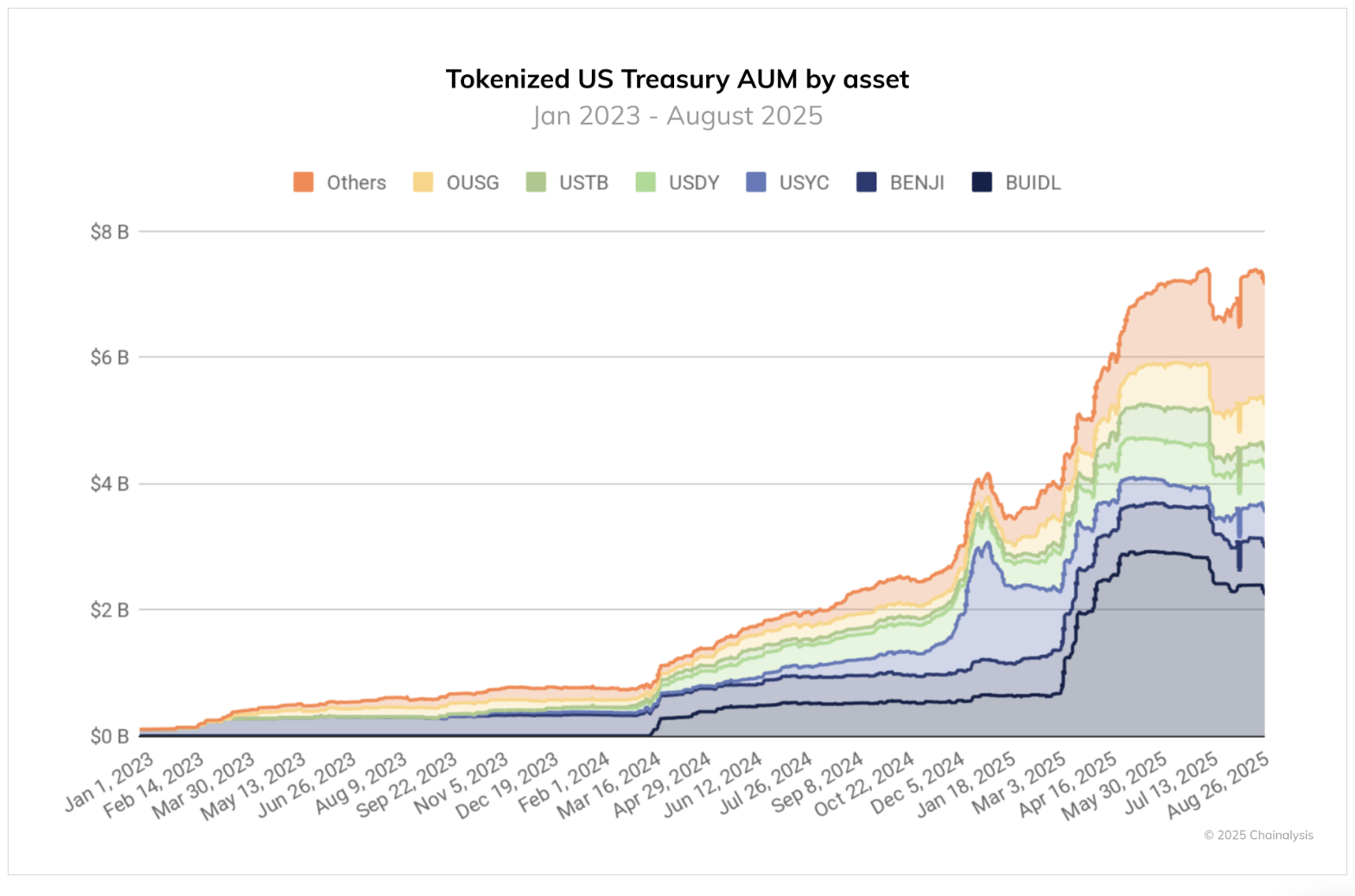

- Tokenized treasuries exploded in value, growing from from $2 billion to $7 billion

- The likely catalyst for these inflows is the election of Donald Trump as U.S. President

U.S. and Canada continue to dominate the crypto ecosystem. On Wednesday, September 17, Chainalysis published a report highlighting North America’s role in the digital assets sector. Between July 2024 and June 2025, the region handled $2.3 trillion in crypto transactions, representing 26% of all global activity.

This activity peaked in December 2024, with wallets based in North America receiving $244 billion in inflows. According to Chainalysis, the majority of this activity came from stablecoin transfers. The month set a record for stablecoin transactions, which still stands.

The likely catalyst for this surge in activity was the election of President Trump in November 2024. Markets viewed the election of a pro-crypto president as a bullish signal and expected greater regulatory clarity. Another contributing factor was quantitative easing in the fourth quarter of 2024, which increased risk appetite across the market.

North America also saw higher volatility in crypto transactions, largely due to more institutional capital and active trading. For instance, September recorded a 35% monthly decline, while November saw an 84% spike.

Tokenized U.S. treasuries explode in value: Chainalysis

U.S. Treasuries became one of the most significant segments of the tokenized asset market. Assets under management of these funds grew from $2 billion in August 2024 to more than $7 billion in August 2025.

While tokenized treasuries remain a small segment of the broader U.S. bond market, their growth highlights strong investor demand for accessible investment vehicles.