PEPE price action is consolidating at a crucial support zone, with technical indicators aligning around a Gartley Harmonic target. Rising open interest and an uptick in volume suggest strong bullish potential if resistance levels are reclaimed.

- PEPE is holding above the 0.618 Fibonacci retracement and Value Area Low, showing strong support.

- The Gartley Harmonic pattern suggests potential expansion toward leg D if momentum builds.

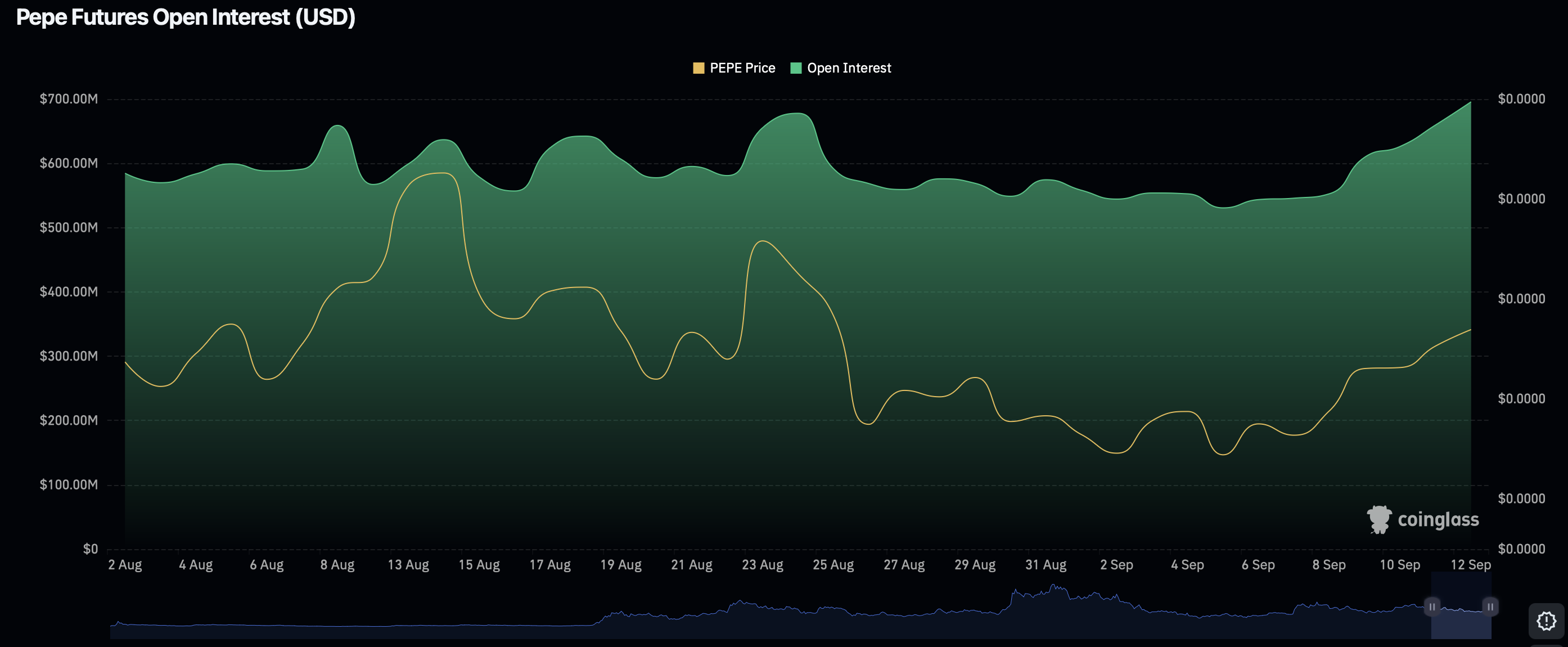

- Futures open interest has risen to $700M, reflecting strong participation but also increased volatility risk.

PEPE (PEPE) continues to defend a vital support region, building the case for a bullish harmonic setup. With Fibonacci confluence, value area structure, and surging futures open interest, the token is positioned for a potential expansion if momentum sustains.

Adding to this outlook, Pepe coin has carved out a strongly bullish falling wedge formation, signaling a potential rebound ahead even as whales and smart money continue to offload their holdings.

PEPE price key technical points

- Critical Support: Price is holding above the Value Area Low and 0.618 Fibonacci retracement.

- Pattern Setup: A Gartley Harmonic points to expansion toward leg D.

- Futures Market: Open interest has surged to $700 million, its highest since early August.

PEPE has established a strong foundation at support, with the 0.618 Fibonacci retracement and Value Area Low acting as a springboard for recovery. Reclaiming the Point of Control signals improving market structure. If price remains above this level, it strengthens the probability of completing the Gartley Harmonic, which requires an advance toward leg D and a breakout above the Value Area High.

The volume profile shows early signs of bullish activity, with increasing inflows hinting at renewed demand. Sustained buying pressure is critical, as the harmonic pattern only confirms if expansion is backed by momentum. Coinbase now allows altcoins like PEPE to be used as collateral for perpetual futures trading, adding further fuel to market participation.

Futures market data further supports the bullish case. Open interest has climbed to $700 million, the highest since August, suggesting strong participation at current prices. This signals a risk-on environment, where traders are willing to commit capital to speculative positions.

However, elevated open interest can also amplify volatility. Should price break below support, liquidation-driven selling could flush out overexposed traders before equilibrium is restored.

What to expect in the coming price action

As long as PEPE holds above the Point of Control and continues to attract buying volume, the Gartley Harmonic setup could trigger expansion toward leg D. Reclaiming the Value Area High would further validate the bullish outlook, though traders should stay cautious of a potential flush if support fails.